Attorney advertisement by Edwin Aiwazian of Lawyers for Justice, P.C., headquartered at 450 N Brand Blvd, Glendale, CA 91203

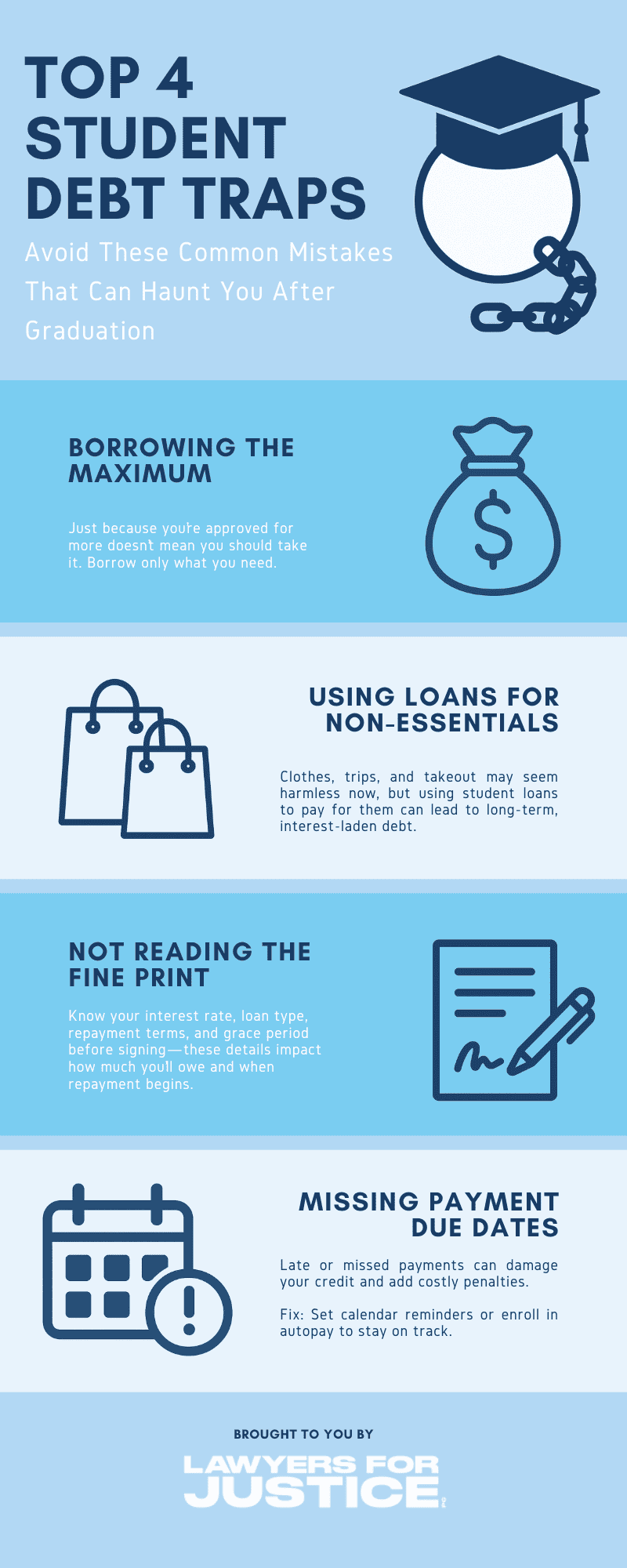

Student loan debt has become a defining burden for millions of young adults—but the risks of financial instability often start long before the first bill arrives. For college students juggling jobs, tuition, and daily expenses, understanding how to avoid legal and financial missteps is just as important as studying for finals.

This guide blends practical financial literacy tips with real-world red flags to avoid—like unfair work-study arrangements, illegal employment practices, and common credit traps.

Why Debt Matters

Colleges are increasingly expected to prepare students not just for academic success, but for real-life financial responsibility. From predatory credit offers, to unpaid internships that violate labor law, young adults face decisions that can affect their financial well-being for years. A clear understanding of risks helps prevent long-term debt cycles and builds confidence in post-college life.

Financial literacy means more than budgeting. It’s about recognizing red flags and asking the right questions—especially when the stakes involve future income and credit health.

Common Pitfalls Facing College Students

- Predatory Credit Card Offers on Campus

Targeted at young adults with no credit history, these offers often have high interest rates and hidden fees. Missed payments can haunt credit scores for years. - Illegal or Unpaid Internships

Not all unpaid internships are legal. If an intern performs the work of an employee without compensation or educational value, they may be protected under labor laws. - Work-Study Wage Violations

Some schools or employers may incorrectly classify work-study students, leading to unpaid overtime or missed breaks, which are common wage theft issues. - Scholarship Identity Scams

Some “free money” websites or email offers are actually phishing scams. Students eager for help may give away personal data like SSNs, which can lead to stolen identities or fraudulent loan applications in their name. - Campus Job “Opportunities” That Break Labor Laws

Watch out for job postings offering “quick cash” for tasks like reshipping packages or marketing crypto. Such offers may violate federal labor rules—or worse, involve individuals in illegal schemes. - Student Loan Forgiveness Myths

Some debt relief programs promote “guaranteed forgiveness” if students pay a fee or provide private info. Oftentimes, such promises are misleading; the real programs (like PSLF) have very specific, documented criteria. - Dorm Room Deals That Lock You Into Long-Term Contracts

From Wi-Fi bundles to “student discount” delivery subscriptions, many dorm-room signups auto-renew or include hidden fees. Students might be paying long after graduation if they don’t read the fine print.

The Bigger Picture: College Debt & the System

With student debt forgiveness still evolving, and Gen Z students entering adulthood during inflation and labor rights crackdowns, conversations around college debt are shifting. More universities are being held accountable for financial wellness education and students are demanding protection not just in tuition policy, but in real-world readiness.

“From TikTok creators explaining FICO scores to campus protests over tuition hikes, Gen Z is rewriting how we talk about debt. But are institutions keeping up?”

It is more important for Gen Z students and younger generations to take initiative and learn their rights and legal responsibilities to avoid getting trapped in financially difficult situations.

Tips/Resources for Avoiding Financial and Legal Trouble:

- Know Your Employee Rights—Even in Part-Time Jobs

As a student worker, you’re still entitled to fair wages, safe working conditions, and breaks. Bookmark your state’s labor law page or use student legal resources on campus. - Don’t Swipe Blindly. Read the Fine Print

Whether it’s a campus credit card, student loan, or textbook rental service, skim the APR, late fees, and repayment terms before signing anything. - Ask: Is This Internship Legal?

If an internship doesn’t provide school credit or clear skill training and involves regular work hours, it’s important to ask questions. The Department of Labor has clear rules on the matter. - Budget for More Than Tuition

Factor in fees, books, transportation, and emergency expenses. Use free college budget calculators to map out all your costs. - Be Cautious with Co-signing or Lending

It may feel generous to help a friend or classmate, but a signature creates a legal obligation. If covering the debt isn’t affordable, it’s best not to co-sign. - Use Campus Legal Resources Early

Many schools offer legal aid or student advocacy centers. They’re free, confidential, and there to help prevent (or fight) financial harm.

Lawyers for Justice, P.C. is Here to Help

Students shouldn’t need a law degree to protect their future. By knowing the rules, spotting shady practices, and using campus and legal resources early, they can graduate with confidence, not confusion. The attorneys at Lawyers for Justice, P.C. can support young workers and students navigating life’s financial curveballs.

Call 818-JUSTICE or fill out our online contact form for a free case review!

Attorney advertisement by Edwin Aiwazian of Lawyers for Justice, P.C., headquartered at 450 N Brand Blvd, Glendale, CA 91203

Think you deserve justice?

-

Get a Free Case Evaluation

-

Retain Service with No Upfront Cost

-

Get the Justice You Deserve

-

No Win, No Pay